Keeping Current: Forecast Roundup, Projections from major real estate organizations.

Keeping Current: Forecast Roundup

Projections from major real estate organizations

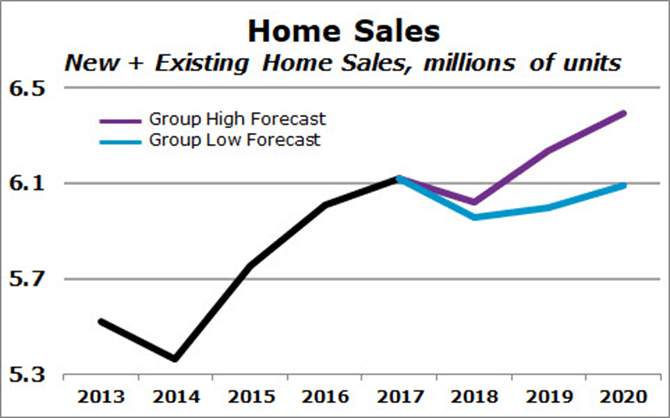

After backtracking in 2018, total home sales are forecast to grow in 2019 and 2020

Slowing home sales in recent months have caused the four major real estate organizations tracked in this report to rein in their projections for home sales this year. Total homes sales for 2018 are, on average, expected to decline 2.0% from last year. That’s a reversal from just six months ago, when total home sales were expected to rise 2.8% this year.

· In 2017, total home sales rose 1.9% to 6.13 million units, its highest annual level since the Great Recession ten years ago. Existing homes sales were up 1.1% for the year, and new home sales climbed 10.0% relative to 2016. 1,2

· Total home sales through the first ten months of 2018 are running 1.6% lower than the same period last year. Existing home sales are 2.1% below their 2017 YTD units, while new home sales are up 2.9% so far this year. 1,2

· The current forecasts for 2018 range from 6.02 million units sold to 5.97 million units sold, or between a 1.6% to a 2.7% drop in sales relative to 2017.

· Growth returns in 2019, according to the forecasts, with projections ranging from 6.00 million units sold to 6.24 million units sold, and an average projection of 6.09 million units. On a percentage basis, that’s an average gain of 2.0%, with a range of 0.6% to 3.6% over 2018 sales

· Total home sales are expected to grow in 2020. The forecast average is 6.24 million units, a gain of 2.4% over 2019. The individual estimates of the increase in 2020 range from 0.8% to 4.3%.

Home prices have fully recovered from the Great Recession, with more growth expected

· In the first quarter of 2016, the U.S. House Price Index surpassed its pre-recession peak levels. The HPI measures the level of prices of homes sold that used agency financing across the country. 3

· Through the third quarter of 2018, the US HPI stood 17.4% above the 2007 peak. 3

· The HPI indicates that U.S. home prices increased at an annual rate of 6.3% in the year ending in the third quarter of 2018. That’s a deceleration from the year-ago changes of 7.4% and 6.8% recorded in the first two quarters of 2018. 3

· Home prices rose over the past year in all but one of the nation’s 100 largest metro areas. Ten MSAs saw home price appreciation at or above 10%, with Boise City and Las Vegas leading with gains of 19.9% and 18.2%, respectively. Home prices in Honolulu dropped 5.1% in the past year. 3

· The median price of existing homes sold rose 5.1% in 2017 and is projected to rise 4.9% this year, according to the average of the three home price forecasts. In 2019 and 2020, the median price of existing homes sold is expected to rise 4.6% and 2.9%, respectively.

· After increasing 4.9% in 2017, the median price of new homes sold will edge down 0.1% in 2018, according to the average of the three home price forecasts. In 2019 and 2020, the average forecast shows gains of 3.7% and 2.1%, respectively, in the median price of new homes sold.

Economic growth to moderate toward the expansion’s average through 2019 – but slow further in 2020

· The economy grew at a 3.5% annualized rate during the third quarter of 2018. 4

· Each of the four organizations expects economic growth to moderate but continue at least through 2020. The quarterly projections through the end of 2019 are very similar, with growth rates nearing the current expansion’s average annual rate of 2.3%.

· If that happens, the current expansion will become the longest on record, beating the 120-month expansion that began in March 1991 and ended exactly 10 years later, in March 2001. The current expansion began in June 2009. 5

· All four organizations project economic growth of less than 2% in 2020. The growth rates for the year range between 1.3% and 1.8%.

Home SalesMedian PricesEconomic Growth Forecasts

Notes:

The Home Sales chart shows the number of home sales by year from 2013 through 2017, plus the highest and lowest forecasts projected in the past month for 2018 and 2019 from four major real estate organizations: Fannie Mae, Freddie Mac, the Mortgage Bankers Association, and the National Association of Realtors®. Each forecast is publicly available without charge from the organization’s website.

The Median Prices – New Homes Sold chart shows the median price for 2013-17 plus the highest and lowest forecasts projected in the past month for 2018 and 2019 from Fannie Mae, the Mortgage Bankers Association, and the National Association of Realtors.

The Economic Growth chart shows the highest and lowest projected changes in GDP for 2018, 2019, and 2020 from the four organizations. Growth is measured on a Q4-over-Q4 basis.

None of these forecasts necessarily represents a projection from Wells Fargo. Economic commentary and projections from the Wells Fargo Economics Group are presented here.

Article written by: Wells Fargo